Photo: Pixabay.com

Imagine a doctor, who is treating a patient for anaemia, deciding to reduce the person’s food intake. Pretending this will be good for him, and will allow him to recover. Accusing his previous doctor of reckless mis-treatment, wasting the hospital’s resources. Think that would never happen?

The year is 2010. Following the Financial Crash of 2008, the banks are still reluctant to lend, businesses are nervous about investing, and consumers are scared to spend. Doctor George Osborne is appointed to take over a patient’s care by new Prime Minister David Cameron. He decides that the patient, United-Kingdom-Economy, who is suffering from a condition close to malnutrition, having been badly weakened by the Financial Crisis, needs to go on a diet, and eat less. He says the hospital is short of food, and has to live within its means, balance the budget, and so on. The relatives and friends all know what it’s like to have to live within a budget, so they agree to this. What they don’t know, is that this hospital has access to unlimited food and medicines, if it chooses to use them. And, that Dr Osborne knows this, and has his own plans for the hospital’s food and medicine.

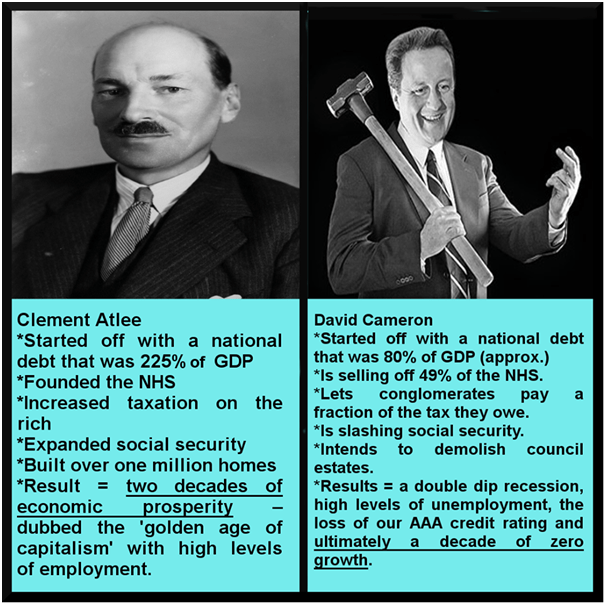

If you have read my earlier pieces in this blog, you will realise that the United Kingdom has its own currency, so can spend into existence whatever amount of pounds sterling it chooses to. Doesn’t have to “borrow” any, doesn’t have to “pay any back”, in real terms. (Bonds, and their interest are repaid when they mature, but as this is done in £sterling, and we have complete control over how many pounds sterling we have access to, it’s not like debts as you or I understand them. See #4, deficits and debt.) But we have been repeatedly told that “there’s no magic money tree”, that Government “borrowing” is dangerously high. That “fiscal responsibility” is important. That the UK could “go bankrupt”. So, budget cuts had to be made, public spending had to be reined in, the wages of public sector workers such as nurses, police officers, fire-fighters, binmen, etc, had to be capped. As Alexei Sayle’s bitter joke went, we were told that “the Financial Crash was caused by too many libraries in Wolverhampton”. The previous government was alleged to have caused the banking crisis by its reckless spending. (Forgetting that the crash was caused by the greed and irresponsibility of the banks and financial services industry, who had been saved from catastrophe with an injection of funds called “quantitative easing” by Gordon Brown’s government, which then merely maintained normal public expenditure).

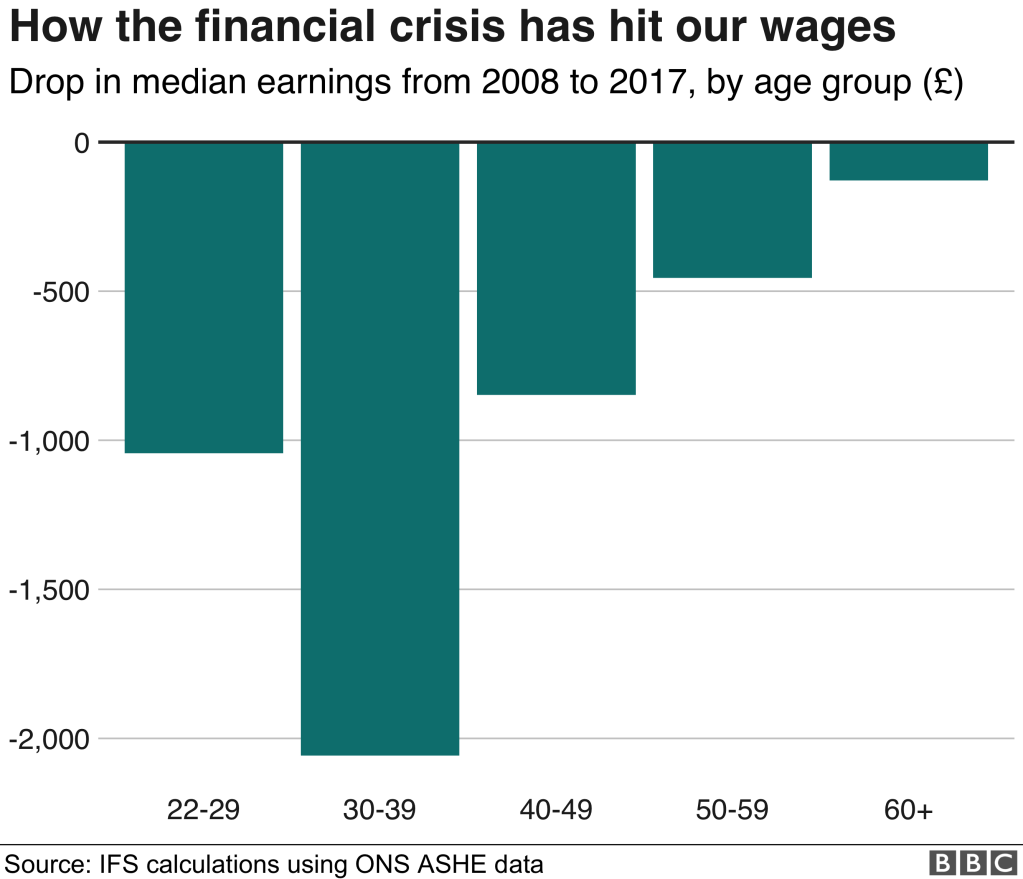

So what happened between 2010 and today? Huge and savage public spending cuts. Not challenged by the papers and TV news, who accepted the official story, and faithfully relayed that to a public who understood very little about economics. (What little they did know was based on an utterly false picture painted by the Monetarist School since the 1970s, which most people still believe). here’s what happened to wages:

Public sector workers are no better off in real terms, than they were in 2009. Police officer numbers were cut by 20,000. Council government support was cut by £billions, so councils had to make reductions in the services they were obliged to provide to the public. The funding of schools was cut so much that today, teachers buy stationery for the pupils to use out of their own pockets, class sizes have risen, and staff are demoralised. Fire stations were closed, and staff numbers cut. Legal aid was severely restricted, so poorer people didn’t have help to get fair access to justice.

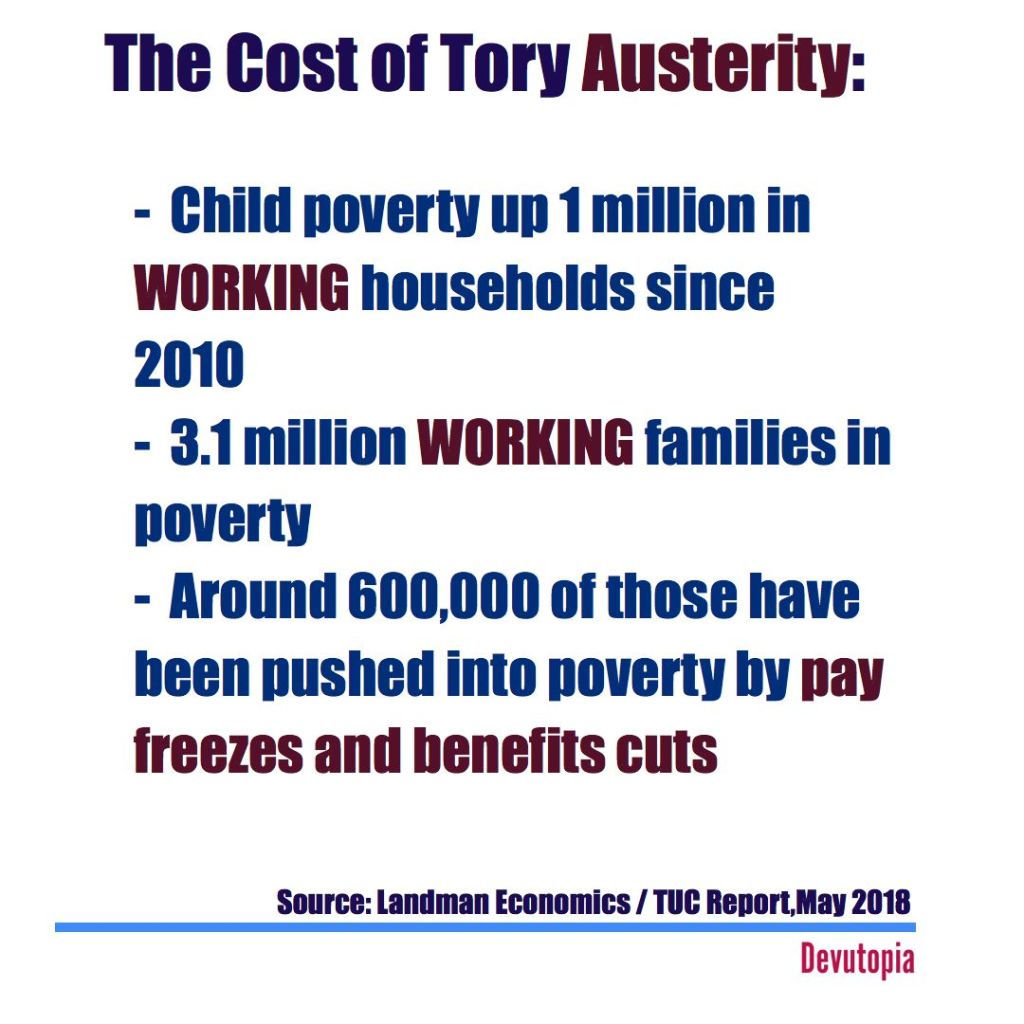

As zero-hours working increased (now approximately 1,000,000 people), and many were forced to rely on precarious self-employment, this combined with wages being kept down, to cause widespread in-work poverty, on a scale not known since the 1920s.

This, together with a 1920s-style harsh benefits regime, including the notorious Universal Credit, (dressed up as “Welfare Reform”), means we now have more foodbanks providing a lifeline to those in real poverty, than the total of McDonalds and Burger King restaurants combined. Even welfare benefits to support those with severe disabilities, have been withdrawn, often by corrupt means.

I could mention many other serious effects on society, but it’s time to consider what effect that all this reduction in public spending has had on the overall economy. Put simply, when a government takes £billions out of an economy, it tanks. People struggle to pay bills, with, for many, little or nothing left over to spend on clothing, household stuff, eating out, gifts, toys, etc, etc. Once prosperous High-Street giants (Toys-R-Us, House of Fraser, Maplin, Debenhams, restaurant chains, and others) have either gone bust or had to reduce staff and close shops. Not just because of the move towards internet shopping. Many towns in less prosperous areas, have many boarded up shops, and little else besides charity shops, cash-converters-type businesses, and pound shops- and even the pound shops are struggling. Unless you live in the wealthier parts of the South-East or South-West, you will know what I am talking about.

So, what happens to tax revenue, when many people have reduced wages, so they pay less income tax? When less goods are sold, so less VAT is paid? When businesses fold, putting people out of work, and paying less business taxes? When large businesses that do survive, make less profit, so pay less Corporation Tax? As I explained in #4 here, the “budget deficit” is (put simply) the difference between what a government spends and how much it claws back in taxation. So today, we have a (relatively) huge budget deficit, with nothing to show for it. Except either reduced living standards, or actual hardship.

All this economic vandalism, is what happens, when governments, aided and abetted by “journalists” who should know better, persuade the people that a government’s financial management is like that of a normal household, so they have “budget constraints”. That we “can’t afford” proper public services. That we “can’t afford” to pay student nurses while they are training. That support for the sick, disabled, and old has to be paid for out of taxes, so we “can’t afford” it. That we “can’t afford” to pay fair wages to essential workers, such as emergency services staff.

A government with its own currency and Central Bank, such as ourselves, or the USA, or Australia, Norway, Canada, etc can no more “run out of money” than the FA can run out of goals. Yes, it is possible in certain circumstances, for public spending to exceed the real resources (people, raw materials, energy) to provide what a country needs, which could cause inflation. But the UK is nowhere near that situation. And, unless governments spend money into the economy as they should, everybody, (except the very rich) suffers.

The sad thing is, it’s not as if we shouldn’t already realise how public money really works. That governments need to provide funds, for a healthy economy. In the 1930s, following the Wall Street Crash, economist J.M. Keynes knew it, and helped to rescue the UK economy. In the 1930s and 1940s, economist Joan Robinson wrote about it. The British wartime government of 1940, and the Attlee government of 1945-1951 understood it. U.S. President Kennedy understood it in the early 1960s:

To sum up: If you have read as far as here, you will now understand why austerity policy is a political choice, not an economic necessity.

And always remember- No Government ever cut its way to prosperity.

(photo: Jeff Morgan08/Alamy)

I am grateful to Malcolm Reavell for his input on some points in this chapter.